Best Place to Buy a Beach House in Delaware

The recession is long gone and prices on properties at Delmarva Beach are back to what existent estate agents consider "normal." If you are thinking about ownership a getaway, here are a few things you might not know about buying in a resort area.

Listen now to WTOP News WTOP.com | Alexa | Google Home | WTOP App | 103.v FM

EDITOR'S Notation: The housing chimera before the recession drove prices up at the Delmarva beaches. And so prices sank. It's been nine years since the end of the recession. Then take the beach communities recovered? In the series, Embankment Real Estate Guide, WTOP's Colleen Kelleher brings you advice on buying, selling and renting at the Delaware and Maryland beaches.

DELMARVA BEACHES — The words "normal" or "stable" may sound bland, but for anyone looking to buy beach property in Delaware or Maryland, that'south what y'all want to hear your real estate agent say 9 years afterward the finish of the Great Recession.

"I consider this to be a normal market place," said real estate broker Allison Stine of The Allison Stine Team at Long & Foster. Stine sells backdrop in Delaware, including in Bethany Embankment and Rehoboth.

"At the moment we're up 15 percent in year-over-year pricing, which I keep proverb is not an insignificant number. We're starting to see the inventory heading down and the prices heading upwardly," said Stine as she reviews information in Long & Foster's Bethany office.

Real estate agents in Sea City, Maryland, agree with her cess.

"I would say the prices are probably effectually 2003-2004 prices considering we had an abnormal price increase in the 2004 to 2007 era, and now prices are dorsum probably where they should be," said Long & Foster real estate amanuensis Steve Mastbrook, who sells in Ocean City and in Delaware.

Considering at that place aren't lots of properties on the market, "people are non able to exist as choosy every bit they used to be," said Joe Wilson, an agent with Condominium Realty, Ltd. in Ocean City.

Stine said she expects the beach market will continue to tighten and prices volition rising because the feeder markets, the markets from which new buyers come — like D.C. and Wilmington, Delaware — are seeing multiple offers on properties, and they are only on the market place a few days.

Making a half dozen- or seven-figure investment in a beach property requires a good fleck of thought. WTOP interviewed real estate agents in Delaware and Maryland to get some tips on ownership a vacation home at the beach. Agents outline a few things that are specific to littoral properties and Delmarva.

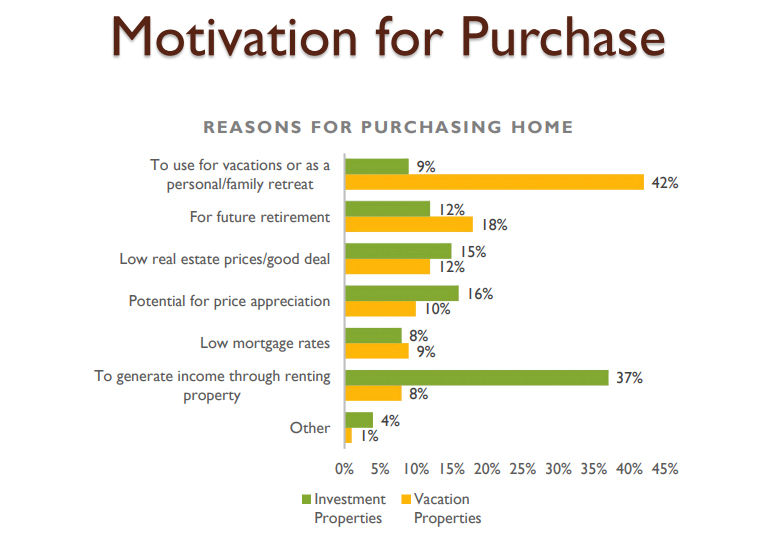

1. KNOW WHAT YOU Desire IN A PROPERTY

Why are you lot ownership a beach property? Is it to create family memories? Is it to relax and get away from the everyday stress of urban life? Is it as a hereafter retirement home?

Buyers Mike and Natalie McEwan have two young children. They wanted to keep making memories and to relax.

Mike McEwan said "quality of life" and having a "stress-free" way to come to the beach on weekends, during the summer and in the offseason mattered as they searched for an Ocean City property final summertime.

"We definitely knew what neighborhood nosotros wanted to be in because we've been coming down hither for 10-plus years and we've rented very close to hither," McEwan said equally he sat in his bayside condo near Northside Park. The condo is located three blocks from the embankment.

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

WTOP/Colleen Kelleher

Courtesy National Association of Realtors

"It was within our reach. It had the space nosotros were looking for. Information technology had the perfect location for the fact we had immature kids," McEwan said. "You could literally park your motorcar when you lot go down here and the furthest matter away that you demand is v blocks away."

Knowing the type of home and location will help narrow the search.

"Some people desire to be on the bayside because they desire to have a gunkhole. Some people want to be on the oceanside because they don't want to cross Coastal Highway with their kids to get to the embankment," said Wilson about Ocean City buyers.

But not all buyers know what they actually want.

Both Long & Foster's Stine and Grace Masten, broker/owner of Sea Grace at North Beach, realtors in Bounding main City, say you demand to be able to explain to an agent how the holding will exist used.

"The about important question that we can ask equally realtors is: 'What do you want to exercise with your property? What practise yous want to achieve? Practice y'all desire to simply come downwardly on the weekends? Are you coming down in the offseason? Do you lot want to brand some rental income for a couple of weeks to pay your condo fees and your taxes? Or do y'all want to purchase every bit a full investment where y'all rent it out continuously?'" Masten said.

New owners, Masten said, oftentimes change their minds almost how they volition use their condos.

"I think their intention when they first purchase is to apply it themselves a lot. And then the realize after the second twelvemonth, baseball game games come up at schoolhouse, or they're traveling somewhere else. So the first ii years, it'south their honeymoon flow. Then afterwards that, they go, 'Mayhap I should consider renting a couple weeks. What harm would that be?'"

She said one time they get the taste of the rental income, some buyers then call back about buying another property "because it'southward a proficient investment."

Whether yous will use your beach property every bit a rental property is of import, Stine said.

"You tin can travel two 1/two miles from the embankment to a resort-type neighborhood. Let's say like a Blank Trap Dunes that has golf and tennis and puddle and clubhouse and restaurant and pro store, and you can purchase a condo, a townhome, a unmarried-family habitation. They volition all exist great rental properties if you decided y'all wanted to get some rental income. You could step 10 anxiety outside the neighborhood, in a random home, in a random neighborhood, and probably not exercise any rental income," Stine said.

two. Wait A 'WOW' MOMENT But BE REALISTIC

Most buyers feel a "wow" moment where they fall in dearest with a property.

When buyers get caught upwards in the "wow" moment — seeing the seagulls flying overhead and hearing the ocean waves in the background — Masten said she makes sure she tempers the moment with a niggling reality.

"I tell my clients, 'You can get emotionally attached to this, nevertheless, let's look at the numbers.' If the numbers aren't making sense, allow's back abroad. Let'due south move in a unlike direction because I don't want yous to be that seller who comes to me 10 years downward the road and say, 'I can't beget this.' Or five years downwardly the route. 'I tin can't beget this. What exercise I have to do?'" Masten said.

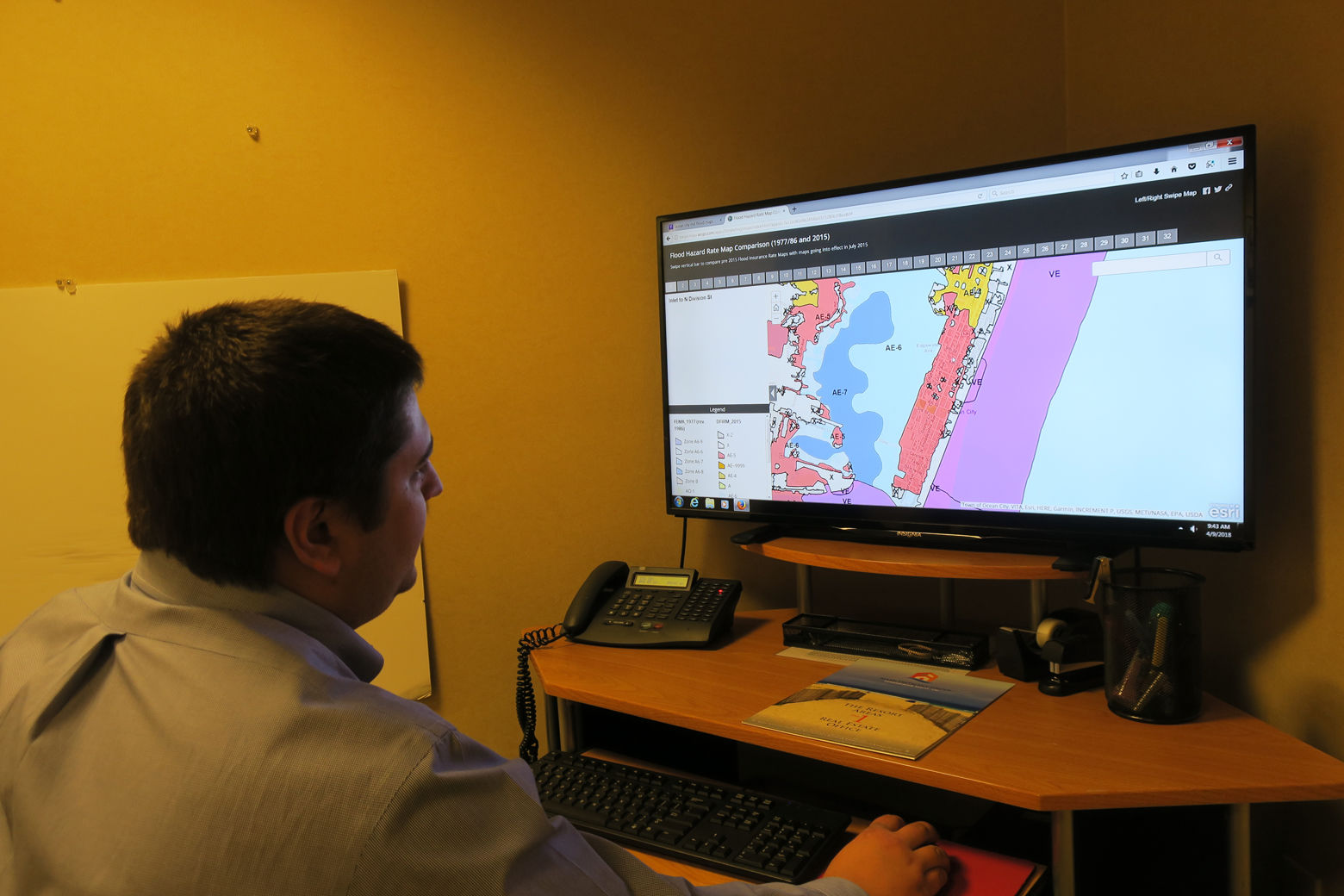

3. REALIZE Y'all MAY NEED Alluvion INSURANCE

I price that tin pack a large whammy in coastal towns is flood insurance. It'south a cost that is continually rising.

Bryan Baker, Long & Foster regional insurance manager, recommends buyers talk with their lenders or their insurance agents early in the process to see what blazon of alluvion zone the property is in.

"As of now, in that location is no contingency to allow someone to get out of a holding contract simply considering information technology's in a flood zone," Baker said.

"If somebody qualifies for financing and there are no other contract contingencies, they're kind of locked into the contract, regardless or not of whether they want flood insurance."

Bakery cautions buyers to not make assumptions by using online mapping tools to determine a property's flood zone. The online data may be wrong and information technology could cost them money.

"The challenge is with high-hazard flood zones. I have personally seen policies range anywhere from $500 a yr to up to $7,000 or $8,000 a year. Information technology merely depends on the domicile, the replacement value, the age, obviously, the bodily flood zone that it is in," Baker said.

Older properties, Baker said, could see inundation insurance costs ascent xv to 18 percent a year.

"If you do non have a mortgage, you are not compelled to purchase overflowing insurance," said existent estate banker Stine, who also has investment and rental backdrop. "Y'all tin buy it as an pick, which I e'er did because I've seen floods. There's nor'easters. They're a piddling bit scarier than hurricanes."

Flood insurance, for some half dozen- and 7-figure buyers in high-adventure areas, may not be a large bargain.

"For the near role, my clients who could afford the mortgages in those locations, they don't actually care about the flood insurance. Information technology'due south the toll of having an oceanfront home or a bay front home," Stine said.

4. Program TO Answer THE Same LOAN QUESTIONS OVER AND OVER

While the procedure of getting a loan hasn't inverse much since the mortgage crunch, what has changed is the amount of documentation required. Expect to be asked a lot more questions about your financial wealth.

Dewey Beach Mayor T.J. Redefer is a broker with Rehoboth Bay Realty.

"The process is painful," Redefer said, describing the undertaking involved with loan documentation.

"They literally want to know how many sheets of toilet paper yous use in the morn. I am just teasing. No, they don't. But they do need to become to the bottom of how they tin make sure yous can afford this house today, where they didn't in the past. It is a more difficult process to become through," Redefer said.

The documentation process is among the biggest complaints Stine gets nigh whatever transaction.

"The loan application itself hasn't changed much over the years, to me," Stine said. "Information technology's merely the supporting documentation. They ask for your income. They verify your income. They verify your income i more time earlier y'all go to closing. They just seem to be asking for the aforementioned things over and over once again."

- 7 tips for buying beach real manor in Del., Md.

- Selling beach belongings? 8 means to get the best cost

- Tips for beach rentals through VRBO, Airbnb

- What's the best beach for the coin?

5. Empathise TRANSFER TAXES

While property taxes are lower in Delaware, ownership property in the First Land will cost you more at the outset. The state's realty transfer tax, which is based on the purchase cost, is higher than the realty transfer tax in Maryland.

Transfer taxes are part of closing costs and add together thousands to the belongings'due south bottom line cost.

Delaware increased its transfer tax to 4 percent in 2017. Information technology had been 3 percent. Buyers and sellers split the cost of the tax that pays for state and local services.

"The transfer tax is ane of the reasons why the belongings taxes are able to stay so low because every time a business firm transfers, the land and the county collect a transfer tax — 2 i/2 percent to the land and i i/2 pct to the county or a municipality, depending on where you are," said Stine.

Buyers and sellers separate the cost of transfer and recordation taxes for Body of water Urban center, Worcester County and Maryland. The tax is 1.66 percentage of the holding's cost.

"Take a typical $300,000 dwelling house. If yous were buying in Ocean City, you would be paying $2,500. It would be $half dozen,000 in Delaware," said Mastbrook.

6. Observe OUT IF At that place IS A GROUND LEASE

You may non own the land below your home, if you buy in parts of Sussex Canton, where the Delaware beaches are located. You may pay a land charter.

"In that location are footing leases throughout the county," Stine said. "Dewey Beach has ground leases in Rehoboth by the Ocean. Bounding main Colony has basis leases. There's a little customs in Bethany chosen Bethany Proper, which is real beautiful, affordable townhomes only they're on ground leases."

Land rent is based on the value of the land and can cost tens of thousands of dollars a year for some backdrop.

Paying to lease the land where your dwelling sits can exist a sensitive upshot. Some buyers dismiss information technology immediately, Stine said.

At Sea Colony in Bethany, where there are ii,200 condominiums, the toll of the ground lease, which is in addition to condominium fees and recreation fees, can exist up to $2,000 a twelvemonth. A lease can be purchased for 12 ½ times its cost. In a resale, it has a value of $25,000.

In Dewey Beach, land rent started in the 1950s when Redefer'due south grandpa and his grandad's male parent-in-law worked with a developer to build those rustic, knotty pine cottages in the north end of the 2-mile-long town.

But for a heir-apparent who can come across beyond the emotional aspect of making a buy, Redefer said it may be cheaper than the debt load on a huge mortgage or less expensive than taxes the heir-apparent paid in other states.

"The perfect buyer in Dewey Beach is a meg-dollar buyer that went to Rehoboth and was very disappointed in what that would become them, five blocks back, kind of looks similar a mobile home but information technology's a modular dwelling. That million-dollar price range is going to exist quite a distance from the beach, and they're disappointed," Redefer said.

"And they come up to Dewey Beach, and they say, 'So I can accept that whole cottage for $300,000 or $400,000?' Yeah, you will have country rent, and the land rent is substantial, but information technology is much cheaper than the debt load you would have had on a $one million purchase in Rehoboth or Bethany or whatsoever of the other towns. For a lot of people, it's the most affordable way to get to the beach."

T.J. Redefer explains how ground leases started in Dewey Beach

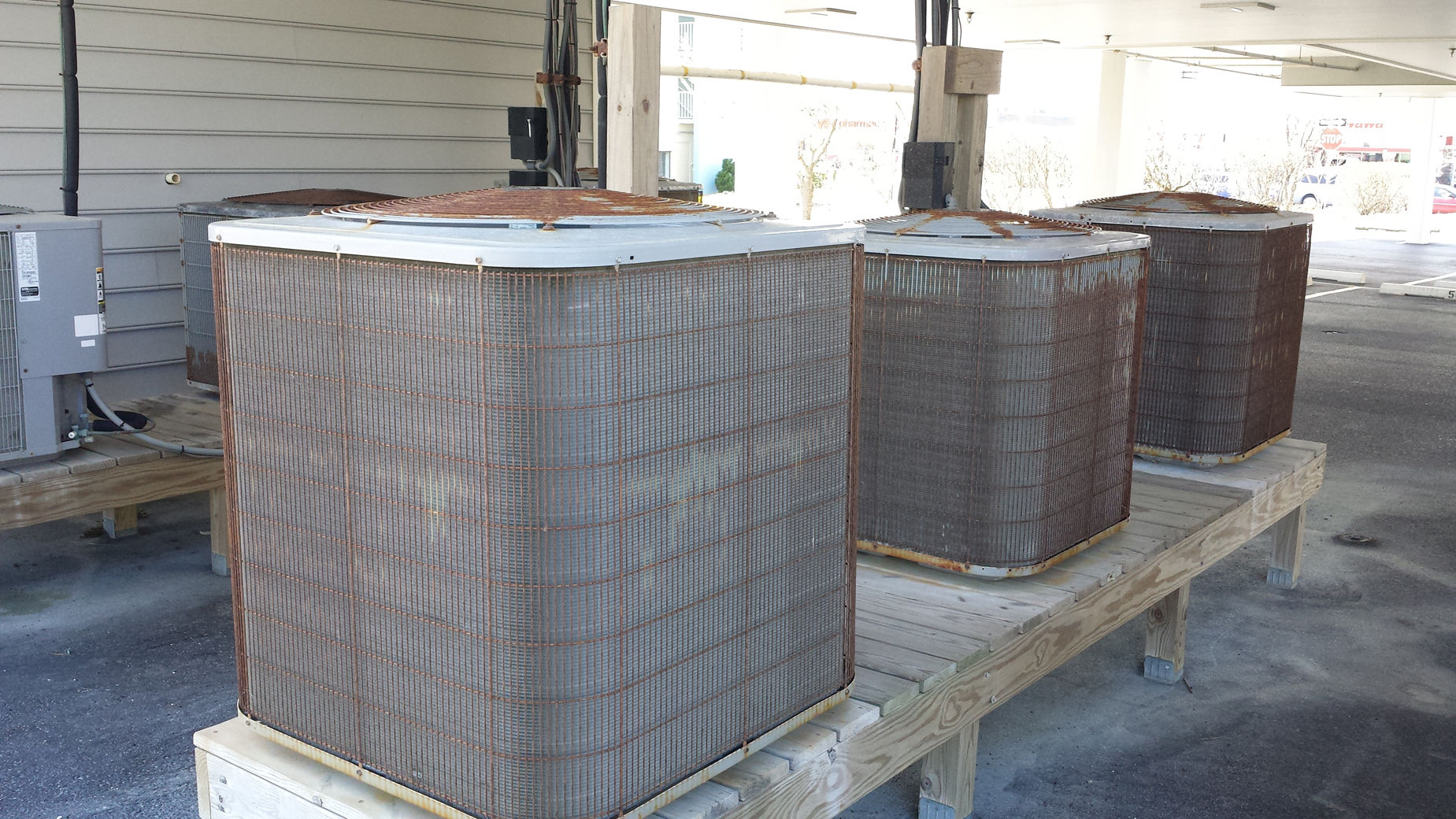

7. CHECK OUT CONDO AND CONDO DOCUMENTS

CONDO FEES

With 30,000 condominiums in Bounding main Urban center and thousands more in lower Delaware, y'all will likely pay a condo fee.

Know exactly what those fees cover and look at whether they are in line with fees in similar buildings, real manor agents advise.

"Condo fees aren't necessarily a bad thing. The fees really embrace the outside of the edifice. And you are really splitting the cost of the roof, railings, steps. If you lot were just paying for it all yourself, it would exist a lot more expensive," said Mastbrook, who owns in both states and sits on a condominium lath of directors.

Condo fees, too known equally dues, volition exist college in buildings that have elevators, pools, clubhouses, game rooms and tennis courts. Upkeep on these items comes from that money.

"Usually, if somebody doesn't want a pool, they don't even want to await at a edifice with a puddle because they're going to be paying for an amenity that they're not even interested in," said Wilson.

Realize that the type of building the condominium is located in could affect whether you are able to get a conforming loan or have to await at other financing options.

Condominiums that have offices or tiki bars or other businesses on their get-go floors rely on the income of those businesses, and lenders take that into account.

"The manner lenders look at information technology is if that business pulls out of that building, information technology's that much coin — $20,000 a yr income that that building loses. So there are simply certain banks that will lend on those buildings, and … it's the local banks," Masten said.

"To get a conforming loan on the properties is going to be a challenge. It'south not that financing isn't available. You're going to pay a unlike rate, a little bit higher rate for a shorter term," Masten said.

CONDOMINIUM DOCUMENTS

A existent estate listing will tell buyers what the condo fee is for a yr, merely it'due south not until they are nether contract that they go the details.

Condominium resale documents volition include the condominium's budget, bylaws, rules and restrictions. Agents recommend reading them closely.

"Sometimes the condo fees may seem high simply the condo is probably putting coin bated in a reserve fund for time to come expenses," Mastbrook said. "A lot of time, people don't realize that that is helpful in the hereafter. That is covering you so y'all might non accept to worry almost special assessments in the time to come."

Special assessments occur when condominium associations don't accept the money needed for capital projects and deferred maintenance, and have to quickly raise the money from the owners.

"The biggest affair is checking to meet how much coin is in their reserve business relationship. Each building should have a reserve fund. And so if in that location is an lift that needs to be replaced or something like that, they're not going to hit you with a special assessment. The money should simply come up out of reserves," Wilson said.

Reserves likewise bear on whether you go a mortgage.

"If you are going to buy in a condominium, virtually people think, 'Oh, they're but looking at me as the buyer and approving me in the mortgage process.' Almost people don't realize they also have to corroborate the condominium building. They have to make sure there is enough money in the reserve business relationship. There'south a lot of standards that revolve around approving the condominium building, in addition to the buyer," Wilson said.

OTHER ODDITIES

The nitty-gritty information in those resale documents could make a difference on whether you lot back out on a sale.

Masten said buyers need to wait at the condominium association's minutes and cheque for any pending lawsuits. She recommends checking for restrictions and annihilation that would hinder how y'all may want to utilise the unit.

For example, there may be restrictions on the type and size of dog owners are immune to have, or whether the condo can be a rental.

"If yous are not happy with what those documents land, you dorsum out of the contract," Masten said.

RIGHT OF FIRST REFUSAL

Some association bylaws date dorsum to the 1960s and oasis't been updated, so they may take clauses that harken dorsum to a time when club was less inclusive.

"Probably ane of the worst ones that'south down here is the right of first refusal from the building. What that ways is if somebody has a property upwardly for sale and a buyer comes in and says he wants to buy it, the rest of the condo owners may have a chance to buy that unit of measurement and stop that potential buyer from buying the property," Mastbrook said.

ON THE RADIO

WTOP turned to real estate professionals for advice and buying tips — now that the market place has normalized — 9 years afterwards the recession. WTOP's Colleen Kelleher reports.

You lot love going to the beach. But should you purchase? Information technology'southward a tough question and one of the hardest decisions you may make. With summertime nigh here, WTOP'due south Colleen Kelleher went to the embankment to get tips from real estate professionals about buying a resort condo.

The interactive chart below, provided by Long & Foster, lets you compare home sales across Delmarva, going dorsum to 2009.

Like WTOP on Facebook and follow @WTOP on Twitter to engage in chat almost this article and others.

© 2022 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.

More than from WTOP

brooksbeggersewen.blogspot.com

Source: https://wtop.com/beach-guide/2018/06/buying-a-beach-place-what-you-need-to-know/

0 Response to "Best Place to Buy a Beach House in Delaware"

Post a Comment